Trading the financial instrument is one of the hardest things in the world especially if you are relatively new in this industry. In order to make profit consistently by trading the financial instrument, you need pin perfect execution of your trading plan. Most of the novice trader in the financial industry fails to make money since they take too much risk in a single trade. But if you truly want to become a professional trader in the financial industry then you need to make sure that you can embrace the long orders in the market. Let’s see the verified equity curve of the professional trader

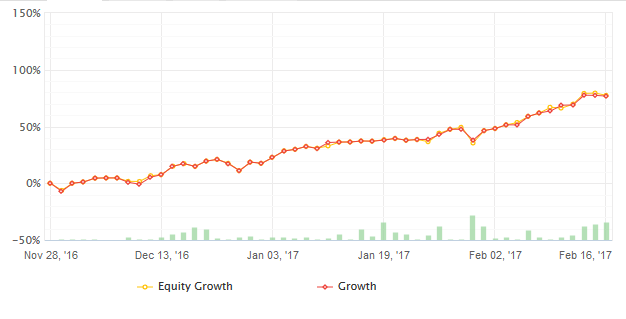

Figure: Verified equity curve of real trading account

From the above figure, you can clearly see that the account has steady growth with some bumps in the uptrend. Most of the novice traders in the financial industry fail to follow proper risk management factors after some few loses. But if you truly want to become a professional trader than it’s highly imperative that you follow risk management factors in every single trade.

Love your losing trade: Most of the novice traders in the financial industry tends to fail in trading since they don’t love losing trades in the market. But as the trader, you should always remember that in order to achieve success in this industry you need to embrace the losing orders in the market just like the winners. If you look at the professional traders than you will notice even they have many consecutive losing orders in the market. There is nothing wrong to accept managed loses in the market so make sure that you don’t risk too much in a single trade and try to execute every single order in the market by following proper risk management factors.

Consider the characteristics of the uptrend: When you trade the financial instrument in the global market you need to remember the characteristics of the uptrend. If you have simple knowledge about the financial market then you know that the market retraces very often while ascending during the uptrend. They hit the minor support levels and create successive higher lows in the market. As a trader, you should also consider that factors in the market and trade the financial instrument. Your account equity curve should also make successive higher lows in the market and it shouldn’t break any support level. You know that the uptrend which rises too quickly in the market often fails so remember that fact and trade according. As a trader, you should be looking for steady growth in your account equity curve and don’t aim to achieve in a single day. You should be always focused on the long-term result of the market since it will help you become a professional trader. Most of the professional trader trades the key support and resistance level in the market with price action confirmation signal. So it’s better for you to master the art of price action trading strategy.

Summary: Trading the financial instrument is an art and it requires an extreme level of discipline. If you truly want to become a professional trader in the financial market then you need to focus on high-quality trade execution. As you saw in the above equity chart the even the professional traders have some losing trades in the market but they always followed perfect risk management factors. In the eyes of trained professional perfect risk management factors is the key to success in the financial sectors. So in order to maintain such a positive equity curve make sure that you have a clear understanding of the forex market and trade with proper risk management factors.